Solana vs Ethereum vs Base: A Trader’s Perspective in 2026

Choosing the right blockchain for your trades isn’t a casual decision in 2026. It directly impacts your cost basis, speed of execution, and access to specific opportunities. The landscape has solidified around three major hubs: the monolithic speed of Solana, the established security of Ethereum, and the low-cost agility of its leading Layer 2, Base. For traders, the solana vs ethereum vs base debate hinges on your strategy’s core requirements.

Each chain offers a distinct blend of fees, transaction finality, and developer momentum. Your choice depends on whether you’re hunting for the next viral meme, executing high-frequency arbitrage, or moving large positions with maximum security.

What Solana vs Ethereum vs Base Means in 2026

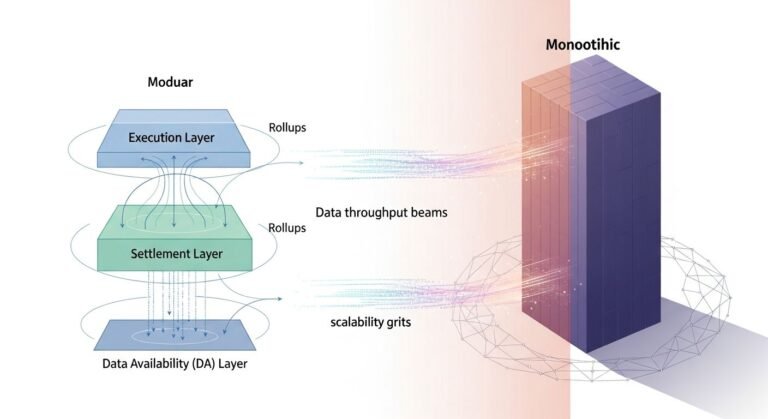

This comparison is no longer about which chain will “win.” It’s about specialization. Ethereum has cemented its role as the foundational settlement layer and DeFi reserve currency hub, with its security and liquidity unmatched. Its high mainnet fees have pushed everyday activity to its Layer 2 ecosystem, where Base has emerged as a dominant force for retail engagement and speculative trading.

Solana operates on a different thesis entirely. It’s a single, high-performance chain designed to handle everything from micropayments to complex DeFi at low cost. The competition is now between specialized environments: Ethereum’s rollup-centric model versus Solana’s integrated, high-throughput approach, with Base representing the most accessible and active front-end of the Ethereum ecosystem.

How Each Chain Actually Works

Understanding their architectural differences explains the trade-offs. Ethereum mainnet relies on a network of validators securing the chain via proof-of-stake. Its focus on decentralization and security creates a bottleneck, leading to high gas fees during congestion. This is the cost of using the most battle-tested execution environment.

Solana uses a unique combination of proof-of-history (a cryptographic clock) and proof-of-stake to order transactions. This allows its validators to process transactions in parallel, achieving theoretical throughput of thousands of transactions per second (TPS). The chain is optimized for speed and low cost, but this comes with a different set of reliability considerations.

Base is an “optimistic rollup” built on top of Ethereum. It batches thousands of transactions off-chain, posts a cryptographic proof to Ethereum mainnet, and assumes those transactions are valid (hence “optimistic”). This inherits Ethereum’s security while offering fees that are a fraction of mainnet costs. The trade-off is a one-week challenge period for withdrawals, though bridging services mitigate this delay.

How Traders Apply These Chains

Traders segment their activity based on chain strengths. For large-cap DeFi positions, yield farming with significant capital, or interacting with blue-chip NFTs, Ethereum mainnet remains the venue. Its deep liquidity and proven smart contracts justify the higher fees for substantial moves.

Solana is the arena for speed-based strategies. Its sub-second block times and negligible fees enable activities that are economically impossible elsewhere: high-frequency trading bots, rapid meme coin sniping, and frictionless interaction with a vast array of experimental DeFi and gaming apps. The entire chain feels built for a trader’s pace.

Base has become the home for Ethereum-aligned speculative trading and social finance. Its integration with Coinbase provides seamless fiat on-ramps, making it the easiest entry point for retail. The ecosystem has developed a strong culture around base meme coins and community-driven projects, offering a blend of low fees and Ethereum-adjacent credibility.

Don’t let low fees be your only criterion. A chain’s reliability during market volatility is critical. Solana has faced outages, while Base and Ethereum L2s benefit from Ethereum’s robust security, even if temporarily slower during extreme congestion.

Fee Structures in Practice

The solana vs l2 fees discussion is nuanced. Solana fees are consistently sub-$0.01, often a fraction of a cent. Base fees typically range from $0.01 to $0.50, spiking during meme coin frenzies but remaining far below Ethereum mainnet, which can easily exceed $50 for a simple swap during peaks.

For a trader executing dozens of transactions daily, this difference is monumental. On Solana or Base, you can experiment with small positions without fee overhead eroding your capital. On Ethereum mainnet, each trade requires careful calculation of gas costs versus potential profit.

Benefits and Trade Offs

Ethereum’s primary benefit is its unparalleled security, decentralization, and the depth of its total value locked (TVL). It’s the bedrock. The trade-off is cost and speed for everyday use, necessitating the Layer 2 ecosystem.

Solana’s benefit is raw performance and unified liquidity. You don’t need to bridge between layers; everything happens in one fast, cheap environment. The trade-off is a history of network instability and a design that prioritizes speed, which some argue comes at the cost of decentralization.

Base’s benefit is the perfect blend: Ethereum’s security with L2 affordability and direct exchange integration. Its trade-off is being part of a more fragmented ethereum rollups comparison landscape, where liquidity can sometimes be siloed compared to Solana’s single pool.

Key Risks and How to Handle Them

Smart contract risk exists everywhere, but due diligence is paramount on newer chains with less audited code. The rapid pace of Solana and Base meme launches increases exposure to scams and rug pulls. Always verify contract ownership, liquidity locks, and community sentiment.

Chain-specific risks differ. Solana’s network congestion can manifest as failed transactions rather than high fees, requiring higher priority tips. Base and other L2s carry bridging risk when moving assets to and from mainnet; use only official, verified bridges.

Liquidity risk is another factor. While deep for major assets, newer tokens on any chain can have thin order books, leading to high slippage. Use limit orders and check trading volume before entering a position, especially on volatile meme coins.

How to Research or Evaluate a Chain

Start with the fundamentals: TVL, daily active addresses, and transaction volume over time. A growing chain shows developer and user momentum. Then, drill into the specifics for traders: DEX volumes, perp trading activity, and the health of the lending markets.

For meme coin activity, monitor social sentiment on Twitter and Telegram, but pair it with on-chain data. Look for sustained increases in unique holders, not just price pumps. The best chain for trading for you is the one with a thriving ecosystem in your niche, whether that’s DeFi derivatives, NFT fi, or meme speculation.

Finally, test the user experience yourself. Send a small amount to each chain, execute a few swaps, and interact with a major dApp. The feel of the wallet interaction, speed of confirmation, and clarity of explorers will tell you more than any report.

Where This Could Go in the Future

The future points toward greater interoperability but continued specialization. We’ll see cross-chain messaging protocols improve, allowing assets and data to flow more freely between Solana, Ethereum, and Base. This will let traders access opportunities on any chain from a single dashboard.

Ethereum’s roadmap, with further rollup scaling and danksharding, aims to push L2 fees down even more, tightening the fee competition with Solana. Solana’s focus is on stability and scaling horizontally through its validator client diversity. Base will likely deepen its integration with the broader Coinbase ecosystem, potentially becoming the default on-ramp for all crypto trading.

The winner isn’t one chain. The mature outcome is a multi-chain world where traders fluidly move capital to where the edge is—security for large holdings, speed for arbitrage, and low-cost virality for speculation.

Conclusion

The solana vs ethereum vs base choice defines your trading workflow. Ethereum mainnet is for high-value, security-first operations. Solana is for strategies where cost and latency are everything. Base is the low-barrier, socially-driven gateway to the Ethereum economy.

Successful traders in 2026 aren’t loyal to one chain. They maintain positions across these environments, leveraging the unique advantage of each. Your portfolio should reflect this multi-chain reality, with assets deployed where they can work most effectively.

FAQ

Which chain is best for beginners?

Base is often the easiest starting point due to its seamless integration with Coinbase for fiat deposits. Fees are low, and the ecosystem is designed for accessibility. Once comfortable, exploring Solana for its speed or Ethereum mainnet for its blue-chip DeFi is a natural progression.

Can I trade the same assets on all three chains?

Not directly. Major assets like USDC and ETH exist as bridged versions (e.g., USDC on Solana, WETH on Base). Their value is pegged, but they are separate tokens on different chains. You need to bridge assets between networks, which involves fees and time delays, especially from L2s to Ethereum mainnet.

Is Solana’s speed worth the perceived centralization risk?

That’s a personal risk assessment. For small to medium-sized trades where speed and cost are critical, many traders accept the trade-off. For long-term, high-value storage, the security of Ethereum (directly or via Base) is often preferred. Diversifying across chains mitigates single-point failure risk.