DePIN Crypto Explained: How Decentralized Physical Infrastructure Is Going Mainstream

In 2026, the DePIN narrative is shifting from a niche curiosity into a serious theme for builders and investors. Understanding how decentralized physical infrastructure works, which DePIN projects lead the space, how to think about the best DePIN tokens, and where the main risks lie can help you decide whether this corner of crypto fits your strategy.

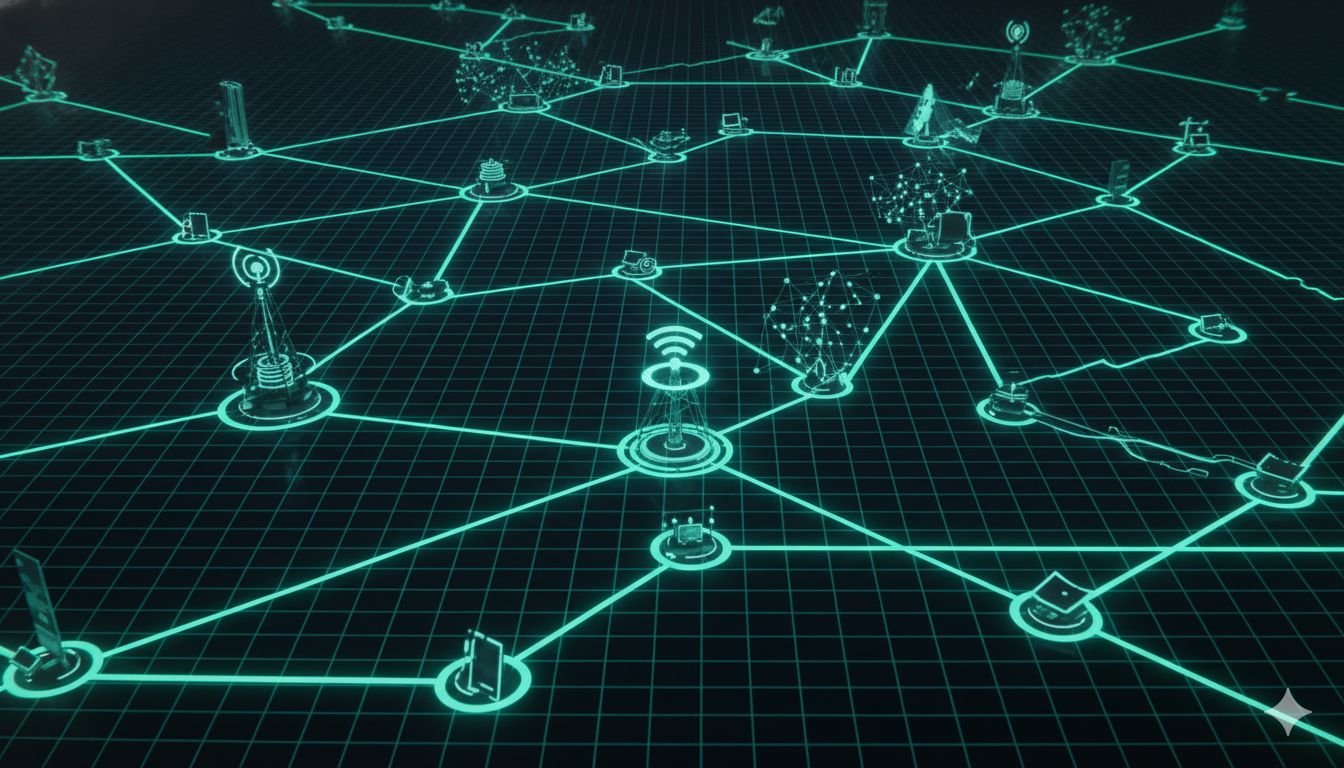

What DePIN Crypto Means for Infrastructure

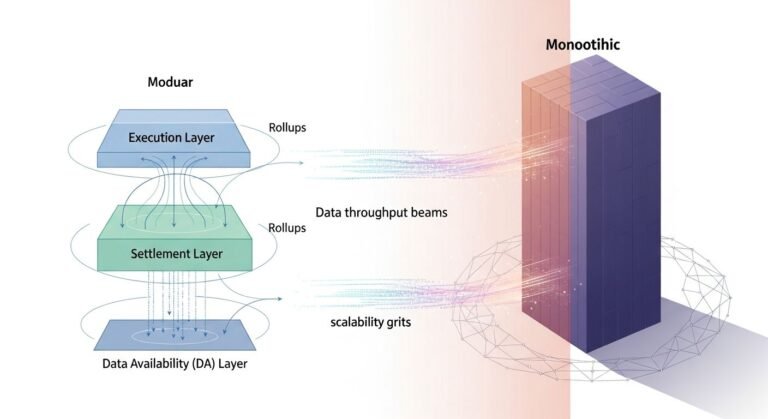

At its core, depin crypto is about using blockchains to coordinate and reward physical infrastructure providers. Instead of a single company owning every device in a network, many participants contribute equipment and receive tokens or revenue shares for providing useful services. The blockchain tracks contributions, distributes rewards, and allows anyone to audit how the system works.

DePIN applies this model to networks such as wireless coverage, GPU compute, storage, mapping, mobility, and more. In each case, participants install hardware or offer capacity, and users pay for access. The goal is to create markets where pricing and availability respond to demand rather than to centralized planning alone.

Decentralized Physical Infrastructure vs Traditional Models

Traditional infrastructure relies on large upfront capital commitments and long planning cycles. In contrast, decentralized physical infrastructure can grow more organically. Individuals can set up a node, hotspot, or device with relatively low friction, guided by incentives and clear participation rules. This allows networks to expand into new regions and niches that might not fit a conventional business case.

Why DePIN Narrative 2026 Is Gaining Momentum

The depin narrative 2026 has grown as more people look for crypto use-cases that touch the real world. As early experiments mature and new projects launch, investors and users see a path where tokens secure something more tangible than pure financial speculation. At the same time, this trend remains young enough that outcomes are far from guaranteed.

How DePIN Crypto Networks Actually Work

Despite different use-cases, many DePIN networks share a common structure. A protocol sets rules for contributions, usage, and rewards. Contributors install hardware or provide services. Clients pay to use the network, often in stablecoins or native tokens. Rewards flow back to those contributing capacity based on verifiable data.

Incentives, Proof, and Measurement

To reward honest participation, DePIN designs rely on ways to measure real-world service quality. This can include cryptographic proofs, audits, sensor data, or cross-checks between nodes. A well-built DePIN project focuses heavily on how it differentiates genuine, useful output from fake activity.

Governance and Token Economics

Depin projects often use their tokens for governance as well as incentives. Token holders may vote on reward schedules, upgrades, or partnerships. Emission curves, lockups, and buyback mechanisms influence whether a token feels more like a productive asset or a one-off reward system that fades when speculation cools.

The strength of a DePIN project rests on more than a whitepaper. Reliable measurement, sustainable incentives, and real user demand are the elements that separate temporary hype from infrastructure that stays online through multiple cycles.

Leading DePIN Projects and Best DePIN Tokens to Watch

Several early networks have helped define the DePIN category. While each comes with its own risks, these examples illustrate how different sectors apply the same core idea of tokenized infrastructure participation.

Wireless Networks and Connectivity

Some of the most widely known depin projects focus on building wireless coverage. Contributors deploy hotspots or small base stations, and users connect through compatible devices. Tokens reward coverage in areas where people actually use the network. These systems aim to blend carrier-grade reliability with open participation.

Compute, Storage, and Sensor Networks

Other networks center on compute, storage, or data gathering. The best depin tokens in these categories often back protocols where demand is visible: AI workloads looking for cheaper GPU access, developers needing distributed storage, or enterprises paying for sensor data. In each case, contributors supply hardware and capacity, while clients pay for services.

How DePIN Crypto Fits Into a Portfolio

For many investors, DePIN sits between infrastructure plays and higher-risk experiments. Tokens connected to successful networks can benefit from long-term usage and recurring revenue. At the same time, early-stage projects may struggle to win users, manage token supply, or maintain device operator interest once initial rewards taper.

Allocating a portion of a portfolio to DePIN themes can give exposure to this narrative without letting it dominate your risk profile. Some users hold basket positions across multiple networks, while others focus on a few high-conviction bets where they understand the underlying service well.

Risks and Challenges in DePIN Crypto

As with any young sector, DePIN carries meaningful challenges. Networks must balance incentives so that contributors remain motivated, users pay sustainable prices, and token economics remain healthy. Poorly designed systems can fall into inflation traps, where new tokens flood the market without building lasting value.

Token Inflation and Misaligned Incentives

One of the largest issues for depin projects is inflation. If rewards stay high for too long without enough real demand, tokens can lose value quickly. Operators then shut down hardware, leaving networks underpowered. Adjusting rewards and focusing on real usage is essential to avoid this spiral.

Regulation and Real-World Constraints

Because DePIN connects directly with physical assets, projects must navigate regulatory environments, local laws, and physical deployment challenges. Wireless projects may need to comply with spectrum rules, while energy or mobility networks face their own frameworks. These realities add complexity beyond typical software-focused crypto protocols.

Where the DePIN Narrative Could Go From Here

The future of depin crypto depends on whether these networks can attract durable demand. If they continue to prove that tokenized participation can build useful infrastructure at scale, DePIN may become a core category alongside DeFi, NFTs, and gaming. If they fail to move past speculative phases, the narrative could shrink until the next wave of designs emerges.

For now, DePIN offers a glimpse of a world where more of the physical environment is built and maintained through open, tokenized coordination. Watching how usage grows, how teams adapt incentives, and how regulators respond will shape whether this story becomes a long-term pillar or a short-lived theme.

Conclusion

When you strip away the buzzwords, depin crypto is about paying people fairly to build and run the hardware that modern life depends on, using blockchains as the coordination engine. The shift from centralized ownership to community-driven infrastructure is ambitious, yet early networks show that it is at least possible to move in that direction.

As you explore DePIN, focusing on fundamentals like real demand, clear measurement, and sustainable token design gives you a better chance of separating lasting projects from short-term experiments. In a market full of narratives, decentralized physical infrastructure is one of the few that must keep working in the real world, not just on charts.

FAQ

Is DePIN only for large investors and companies?

No. Many DePIN networks are built for individuals and small operators to participate by deploying hardware or sharing capacity. Large players may join later, but the model is designed to be open.

How do I evaluate the best DePIN tokens?

Look at whether the network has real users, clear pricing, and transparent rules for rewards. Study token supply, emission schedules, and the team’s history of delivering on promises before allocating capital.

Does DePIN depend on one specific blockchain?

DePIN projects exist across multiple ecosystems, including Ethereum, Solana, and specialized chains. The core idea of decentralized physical infrastructure can run on different bases, each with trade-offs.

What is the main risk of investing in DePIN projects?

The biggest risk is that networks fail to attract enough real demand to support token prices and operator incentives. In that case, tokens may trend down over time even if the technology works as intended.