Bitcoin Layer 2s in 2026: Stacks, Runes and the Future of BTC Utility

Instead of trying to replace Bitcoin, these systems aim to extend it. Networks like stacks bitcoin, emerging bitcoin l2 projects and the bitcoin runes token standard are all attempts to let BTC do more than sit in cold storage while still respecting Bitcoin’s security and culture.

What Bitcoin Layer 2 Means in 2026

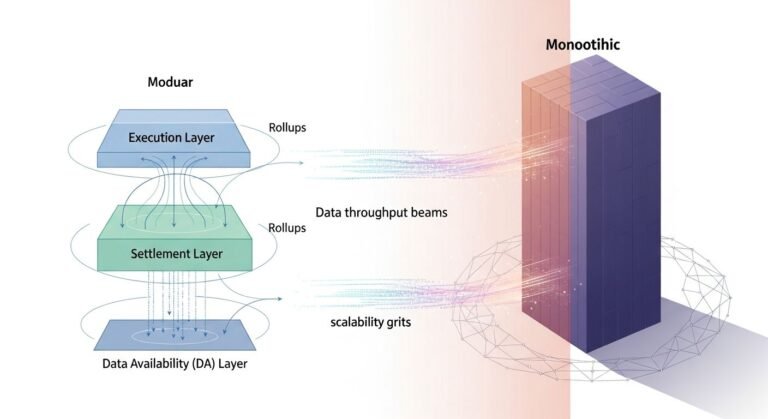

Bitcoin layer 2 solutions are systems that move some activity off the main Bitcoin chain while keeping security or settlement anchored to it. The core idea is that base layer Bitcoin remains conservative, slow changing and focused on simple, robust rules, while L2s handle experimentation and higher throughput.

This mirrors how rollups work in other ecosystems. The difference is that Bitcoin’s scripting language and governance are more constrained, so L2 designs have to work around those limits using sidechains, pegged assets, proof systems or alternative settlement patterns.

How Stacks, Runes and Other Bitcoin L2 Projects Work

Several designs compete for attention under the bitcoin layer 2 banner. They do not all use the same security model, yet they share the goal of increasing what users can do with BTC.

Stacks: Smart contracts secured by Bitcoin

Stacks is one of the longest running bitcoin l2 projects. It uses its own chain and clarity smart contracts while anchoring blocks to Bitcoin through a mechanism called proof of transfer. Stacks blocks settle to Bitcoin, and the network aims to let apps tap into BTC as collateral and value while running logic on Stacks.

For users, this means they can interact with lending markets, NFTs and other applications in the Stacks ecosystem while still viewing Bitcoin as the ultimate reference point for settlement and security.

Runes: A native style token protocol

bitcoin runes is a newer protocol focused on bringing a more efficient token standard to the Bitcoin base layer. It builds on lessons from earlier experiments like ordinals and BRC style assets, aiming to encode fungible tokens in a cleaner, more scalable format.

Runes by itself is not a full L2, yet it is a key part of the broader picture. Tokens created with Runes can form the building blocks for liquidity, meme culture and even future Bitcoin DeFi structures that connect to layers above.

Sidechains, rollups and payment channels

Alongside Stacks and Runes, a wider field of bitcoin l2 projects explore sidechains, rollup style constructions and channel networks. Payment focused systems still rely heavily on ideas introduced by the Lightning Network, while newer designs look at ways to prove state transitions back to Bitcoin in compact forms.

No single model owns the label “Bitcoin layer 2”. Each approach trades off trust assumptions, flexibility and closeness to the base chain.

Why Bitcoin Layer 2s Matter for BTC Holders

For many holders, Bitcoin’s main role has been long term storage of value. That story is still strong, yet the opportunity cost of keeping BTC idle increases as other ecosystems offer yield, composability and richer applications.

If layer 2 infrastructure can safely extend Bitcoin into more expressive environments, BTC can become base collateral for new markets without forcing users to leave the Bitcoin universe entirely. In that scenario, bitcoin defi stops being a meme and starts looking like a real segment of on chain activity.

Benefits and Trade Offs of Using Bitcoin Layer 2s

The main benefit of Bitcoin L2s is obvious: more things to do with BTC. Lending, trading, stablecoin access and even gaming or social apps all become possible when smart contract environments connect to Bitcoin balances.

The trade offs show up in trust models and UX. Some systems require users to trust a federation, a separate validator set or bridging contracts. Others inherit more from Bitcoin itself but move slowly or feel complex to use. Builders and users have to decide how much additional risk they accept in exchange for extra utility.

Treat every bitcoin layer 2 as a different set of promises. Ask which parts rely on Bitcoin, which parts rely on new actors and what happens if those actors fail.

Key Risks and How to Handle Them

Bridge and peg risk: Moving BTC into L2 environments often involves wrapping, pegging or locking coins in multisig setups. History shows that bridges can fail through bugs, attacks or operational mistakes.

Protocol maturity: Many bitcoin l2 projects are young. Smart contracts, consensus rules and economic incentives may still change. Early users stand closer to edge cases and upgrades.

Liquidity fragmentation: As more systems launch, BTC liquidity splits between them. Thin markets can make it harder to exit positions without moving prices.

Handling these risks means starting with small size, sticking to well audited and widely reviewed systems, and treating yield or extra features as a bonus rather than a reason to move an entire stack off base layer Bitcoin.

How to Research Bitcoin L2 Projects

Research starts with understanding the trust assumptions. When you deposit BTC into an L2, who or what controls the keys. Is it a federation, a single entity, a smart contract on Bitcoin, or some combination.

Next, look at how close the project is to real usage. Activity from builders, integrations with wallets and listings on respected services all signal traction. Networks that only exist on slide decks or hype threads deserve more caution.

Finally, consider how each system fits your own goals. A trader who wants fast experimentation might lean toward more flexible environments, while a long term holder interested in light BTC yield could pick slower moving, more conservative designs.

Where Bitcoin Utility Could Go in the Future

Over the coming years, Bitcoin is likely to keep its role as a primary store of value while also gaining more structured utility in layered systems. Base layer changes will remain conservative; most of the experimentation will happen off chain or in protocols like Runes that use available space carefully.

If the stronger designs win market share, BTC could end up as core collateral in lending markets, routing asset in settlement flows and the main reserve asset for Bitcoin native stablecoins and synthetic instruments. That would give bitcoin defi a real foundation instead of leaving it as a copy of EVM patterns on thinner rails.

Conclusion

bitcoin layer 2 2026 is about stretching what Bitcoin can do without breaking what makes it valuable. Systems like Stacks, Runes and other L2 experiments all explore different answers to the same question: how can BTC power more of the on chain economy while staying true to its base layer design.

If you are clear on your risk tolerance, careful about how you move coins and selective about which bitcoin l2 projects you trust, you can explore the growing Bitcoin utility stack without turning your long term savings into test funds.

FAQ

Do I need to use a Bitcoin layer 2 to benefit from BTC long term

No. Many investors are comfortable holding BTC on the base layer or through simple custodial products. Layer 2s are for people who want additional utility or yield and are willing to accept extra complexity.

Is Runes a true layer 2 or just a token protocol

Runes is a token protocol on the base layer rather than a separate L2. It matters because it expands what can be issued on Bitcoin, and those tokens can later plug into layer 2 systems that build on top.

How much BTC should I move into bitcoin defi experiments

A common approach is to keep the majority of holdings in simple, low risk setups and allocate only a small, clearly defined portion to L2 and DeFi experiments. That way unexpected issues on a single project do not threaten your entire Bitcoin stack.